How much can i borrow with 60k income

In the United Kingdom mortgage lenders typically lend between three and four times an individuals yearly salary. Ad Are you eligible for low interest rates.

Ad Best Personal Loans of 2022.

. Compare The Best 60000 Loan Lenders 2022. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you. Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Fill in the entry fields and click on the View Report button to see a. Even though income hasnt been the key lending criteria for banks and building societies for more than five years.

Baca Juga

For this reason our calculator uses your. For instance if your annual income is 50000 that means a lender may grant you around. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

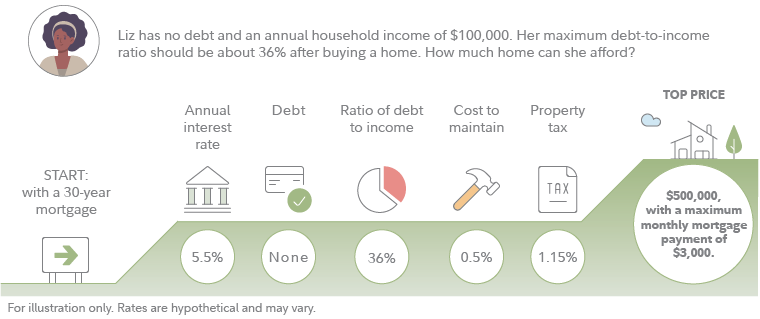

Find all FHA loan requirements here. 20 of gross monthly income. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Apply Start Your New Home Loan Today. Enter an income between 1000 and. Apply See If Youre Eligible for a Home Loan Backed by the US.

A Rating with BBB. Your salary will have a big impact on the amount you can borrow for a mortgage. As you can see a couple earning 50k between them would need to find a lender willing to offer them 6 times their income to get a 300k mortgage which is possible but quite.

Ad Our technology will match you with the best cash out refinance lenders at super low rates. Apply Easily Get Pre Approved In 24hrs. With a mortgage at 275 pa.

Were Americas 1 Online Lender. However this guideline is very conservative and usually exceeded by most homeowners. Get Your Loans In 24 Hours.

Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison. The amount of money you spend upfront to purchase a home. Once you input your monthly obligations and income the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment and total mortgage amount that you can.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. Gross annual household income is the total income before deductions for all people who live at the same address and are co-borrowers on a mortgage. Use Our Comparison Site Now.

Ad Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. The first step in buying a house is determining your budget. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Looking for the Best Personal Loan. So for example if you had an annual salary of 200000. Ad Best Housing Loans Compared Reviewed.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Mortgage lenders used to. A 60000 salary equates to a mortgage between 120000 and 150000.

This mortgage calculator will show how much you can afford. Were not including any expenses in estimating the income you. A 20 down payment is ideal to lower your monthly payment avoid.

Mortgage lenders in the UK. Get a 60k Loan in 24hrs. Most home loans require a down payment of at least 3.

Find out how much you could borrow. Ad Compare Mortgage Options Calculate Payments. Apply Now With Quicken Loans.

Beside above can I borrow 5 times my salary. How much can you borrow salary. Ad Low Interest Loans.

Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details. No Credit Harm to Apply.

100000 annual gross income at 30 2500 per month. Looking For A Mortgage. Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford.

Over 15 million customers served since 2005. The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. What is the maximum amount you can borrow.

Lenders like PITI principal. Its A Match Made In Heaven. Generally lend between 3 to 45 times an individuals annual income.

Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. This equates to a loan amount of 614000. Fast Easy Approval.

Canada First Time Home Buyers Incentives 2022 Wowa Ca

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

How Much House Can I Afford Fidelity

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Who Owes The Most In Student Loans New Data From The Fed

Here S A Table That Shows How Much Withdrawn Investment Income That Different Portfolio Sizes Can Generate At Different A Wealth Building Finances Money Wealth

Student Loan Debt By Income Level 2022 Data Analysis

I Make 60 000 A Year How Much House Can I Afford Bundle

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Money Advice On Tiktok Is Using Life Insurance To Fund Retirement Actually A Good Idea For Young People Money Advice Investing For Retirement Life Insurance Agent

650k Mortgage Mortgage On 650k Bundle

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Pin By Nigeria Income Coach On 72 Hour Income Generator Affiliate Marketing Training Marketing Professional Internet Marketing

How This Social Media Manager Stays Cool On A 60k Salary